The Hidden Cost of Traditional Payments: Why Global SaaS Companies Are Looking for Better Solutions

Every day, thousands of SaaS companies leave money on the table without even realizing it. While they've mastered the art of building software that serves customers worldwide, there's a critical gap between their global ambitions and their ability to actually collect revenue.

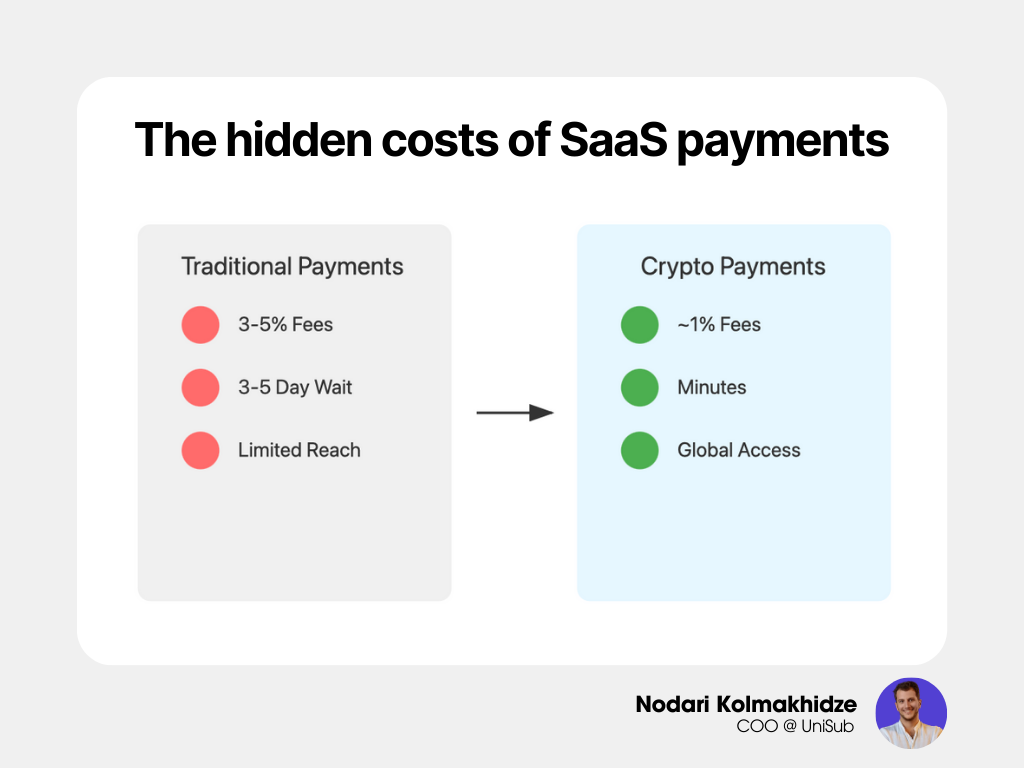

The problem is that traditional payment systems weren’t built for the way modern software companies operate. If you're running a SaaS business, you've likely experienced the frustration of losing potential customers simply because you couldn't process their payments, or watching your margins shrink due to mounting transaction fees.

So what can you do about it? Let's look at the real impact of outdated payment systems on your business.

When Traditional Payment Systems Hold You Back

For most SaaS companies, payment processing is an afterthought – until it becomes a nightmare. The challenges usually surface gradually: a failed transaction here, a delayed payment there. But over time, these issues compound into serious obstacles that can threaten your growth.

Here are what some of these scenarios may look like:

1. Profit-eating transaction fees

Picture this: Your company just closed its best month ever, with $100,000 in new subscriptions. But after the dust settles, you realize that $3,500 to $5,000 of that revenue vanished into transaction fees. For high-volume businesses, these fees are resources that could have been invested in product development or customer acquisition.

2. Slow cash flow

Waiting 3-5 business days for payments to clear feels like an eternity. Yet that's exactly what many SaaS companies face with traditional payment processors. This delay not only affects your cash flow, but also impacts your ability to make quick decisions and seize opportunities.

3. Global expansion roadblocks

You might have customers eager to use your software in emerging markets like Southeast Asia or Latin America. But if they can't pay you due to cross-border payment restrictions or local banking limitations, those potential customers remain forever out of reach.

4. Fighting fraud

Each chargeback dispute drains time and energy from your team. As digital transactions increase, so does the sophistication of fraud attempts, forcing companies to constantly update their fraud prevention strategies.

A New Approach to Payments

Some SaaS companies have found an unexpected solution to these challenges through cryptocurrency payments. Take Shopify's journey, for instance. After implementing cryptocurrency payment options, the e-commerce giant saw remarkable growth in 2020. Their payment volume more than doubled, driving an impressive 86% increase in revenue. The addition of crypto payments played a key role in attracting new merchants and expanding their market reach.

Consider Ondato's experience as well. The identity verification platform discovered that stablecoin payments, particularly USDT, resonated strongly with their global customer base. These transactions now make up 94% of their crypto payments, providing a stable, efficient payment channel that works across borders.

What Makes This Approach Different?

The advantages of crypto payments for SaaS businesses come down to practical benefits that directly impact operations:

- Transaction fees that often amount to less than 1% of payment value

- Nearly instant settlement, giving you immediate access to your revenue

- Borderless transactions that work the same way whether your customer is in New York or New Delhi

- Built-in security features that reduce fraud risks and simplify dispute resolution

These benefits compound over time. Lower transaction fees mean more resources for growth, faster settlements improve cash flow management, global accessibility opens new markets, and better security reduces operational overhead.

Looking Ahead

By 2025, analysts predict that 8% of people worldwide will be using digital assets in some form. This shift reflects the broader evolution of business payments in our digital economy.

SaaS companies at the forefront of this change are discovering significant competitive advantages through modern payment solutions. Their experiences demonstrate how updated payment systems can drive business growth and operational efficiency.

Time to Modernize?

If you're still relying solely on traditional payment methods, you might be limiting your company's potential without realizing it. The good news is that modernizing your payment system doesn't have to be complicated or risky.

Ready to explore how your SaaS business could benefit from modern payment solutions? Sign up now to start implementing crypto payments for your subscription business.